Deferred Capex

The Deferred Capex model is a way for individuals or companies to own a solar power system without having to pay the entire cost upfront. They can rather spread the cost over time. It’s like a “pay-as-you-go” plan for solar energy, where you get the benefits of owning the solar asset, such as reduced electricity bills and environmental benefits, without making a large initial investment. This model makes it easier for more people to go solar and contribute to a cleaner and sustainable future without the financial burden of buying the system outright.

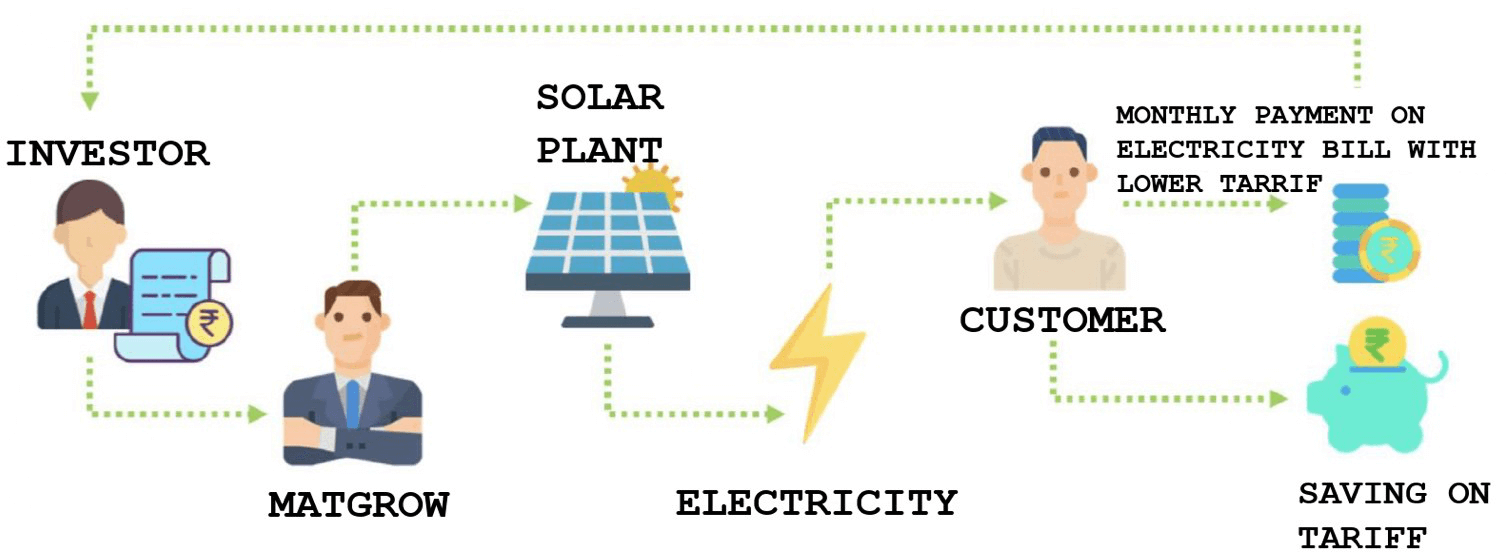

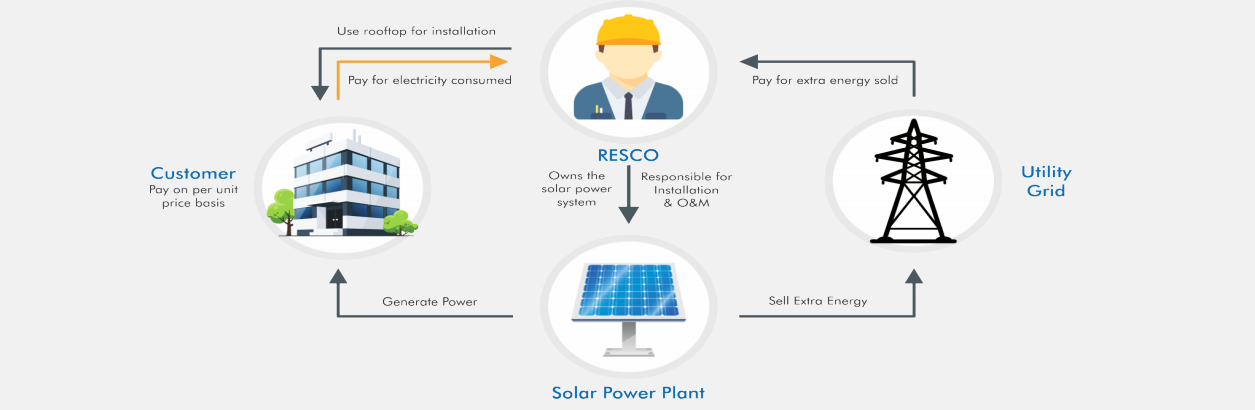

Opex

You can avail hassle-free access to renewable energy with the Opex model as there is no upfront investment or performance risk. The solar project is owned by Matgrow Renewables, and you only pay for the energy you use, usually at prices that are 20–40% less than grid tariffs. Take advantage of our solar, wind, or wind-solar hybrid solutions to get clean energy all day long, combined with energy storage. Our team takes care of all maintenance and operation for 25 years. Sign a Power Purchase Agreement (PPA) with us to save on power bills, making sustainability an easy and cost-effective solution. Embrace the future of energy with the Opex model.

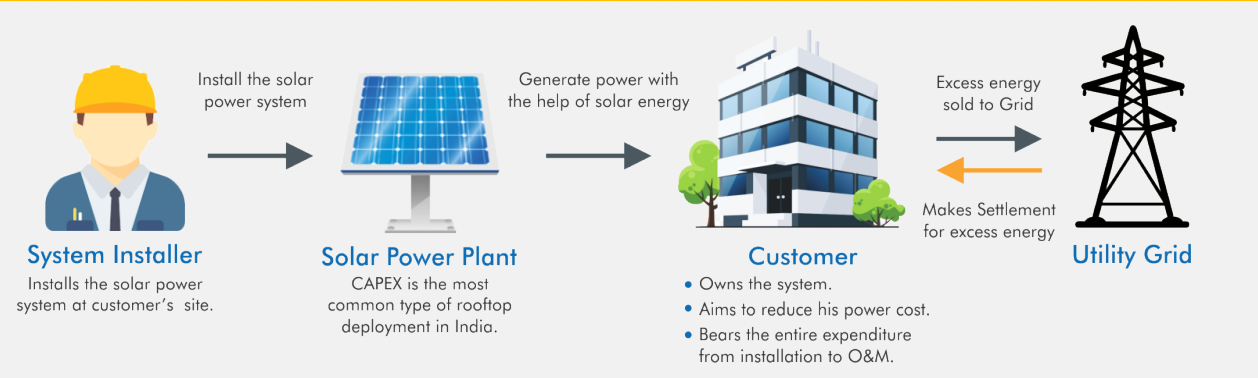

Capex

In the Capex model, you, the power consumer, take ownership of the solar asset. Matgrow Renewables installs the energy plant, be it an off-site wind/solar/wind-solar hybrid farm or a rooftop solar plant, while you pay for the equipment, design, installation, and commissioning costs. Under an operation and maintenance agreement, our skilled engineers assure effective plant operations with an annual contract. This approach provides advantages such as a reduced carbon footprint and a chance to claim tax benefits through rapid depreciation. Own the asset, embrace sustainability, and reap long-term rewards with the Capex model.

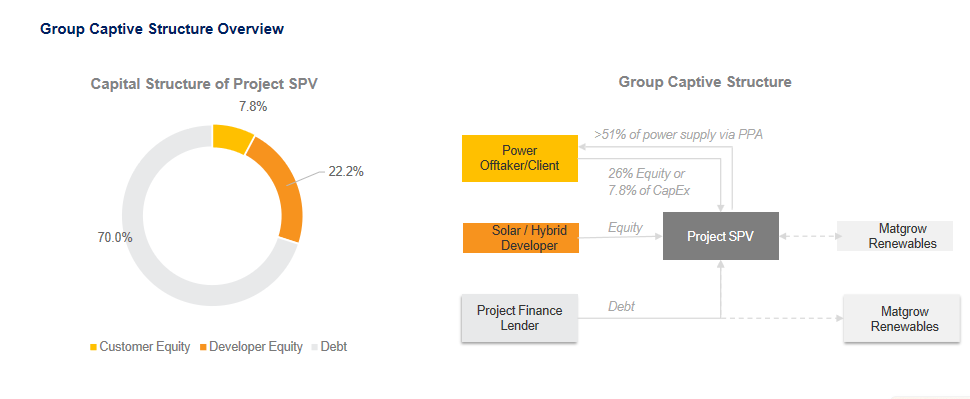

Group Captive Structure

Typical PPA vs Deferred CAPEX Model

Parameter

Typical PPA Model

Deferred CAPEX

74% Equity Ownership by Developer26%

Equity Ownership by Customer

Group Captive wherein CSS is not applicable; Additional

Surcharge might be applicable

Accrue to Developer

Payment = Tariff x Energy generation

Applicable as it’sNot sale of electricity

GST input credit can be availed as it is generation linked payment

Developer pledges SPV shares to lender and also hypothecates assets to lender

Parameter

Typical PPA Model

74% Equity Ownership by Developer26%

Equity Ownership by Customer

Group Captive wherein CSS is not applicable; Additional

Surcharge might be applicable

Accrue to Developer

Payment = Tariff x Energy generation

Applicable as it’sNot sale of electricity

Developer pledges SPV shares to lender and also hypothecates assets to lender

Deferred CAPEX

GST input credit can be availed as it is generation linked payment